Cisco's Global mobile and visual data traffic reports and forecasts are out for 2012 and beyond, and the key finding is that they've significantly lowered their forecast data traffic growth rates in some key areas from their 2011 forecasts. They attribute the revision to several fundamental shifts in usage patterns in 2012.

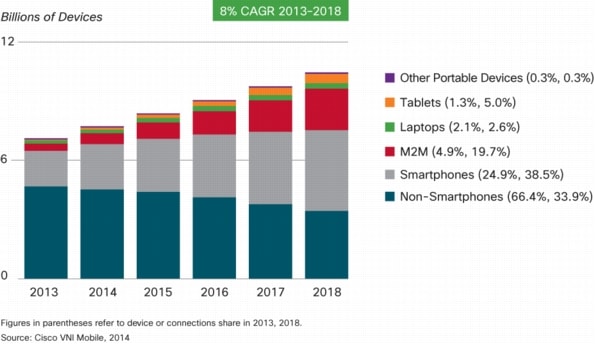

Now data traffic is still growing rapidly across the globe, and mobile data traffic grew 70% in 2012. In fact, Cisco notes, last year's mobile data traffic (885 petabytes per month) was twelve times the entire global data traffic in 2000 (75 petabytes per month). Last year was also the first that saw mobile video traffic account for half of all mobile data traffic. Last year also saw mobile data connection speeds doubled - avg. download speeds for smartphones were just above 2 Mbps, for tablets, average connection speeds were near 3.7 Mbps. And data traffic is still projected to grow exponentially, just at a slightly lower rate.2012 also saw the number of mobile-connected tablets increase 250%, reaching 36 million, and the number of 4G mobile subscribers approached one percent of all mobile connections. Still, even with that low early penetration, 4G mobile subscribers generated 14% of all mobile data traffic. These high-end mobile devices all push mobile data traffic higher, so that continued diffusion will continue to drive continued rapid growth in mobile data traffic.

As for the changes, they're attributable to shifts in usage patterns driven by pricing strategies interacting with improved mobile devices. The report notes that the growth rate for mobile-connected laptops has slowed, as users move to smartphones and tablets as their primary mobile devices. The report also notes that the rise of mobile devices has shifted some use from wired connections to mobile, and particularly WiFi wireless connections. In particular, Cisco indicated that 2012 saw "higher than expected tablet usage on WiFi." Finally, 2012 saw the widespread implementation of tiered and capped mobile data plans from mobile operators. The new plans and caps also pushed a lot of mobile traffic to WiFi home nets connected to fixed network providers. The report suggested that about a third of all data traffic generated by mobile devices was offloaded to the fixed network, rather than remaining on the user's mobile service. To the extent that shifting data usage was a strategic goal (to prevent overloading of older, low bandwidth mobile services, this can be interpreted as attempts to make more efficient use of the current mix of data services and access technologies.

Another way of looking at this is that consumers are becoming smarter - shifting some uses to mobile devices for convenience and 24/7 accessibility, shifting high-data-traffic usage to cheaper and free access points, and shifting emerging usage patterns as mobile service plans evolve to usage-based pricing.

Another way of looking at this is that consumers are becoming smarter - shifting some uses to mobile devices for convenience and 24/7 accessibility, shifting high-data-traffic usage to cheaper and free access points, and shifting emerging usage patterns as mobile service plans evolve to usage-based pricing.Lost in all this is the transformation of mobile service business model. The foundational services of voice and SMS are experiencing declining revenues as users shift to free IP Voice and conferencing services, and the fact of declining costs continues to drive price competition among competitors.

Swisscom’s CEO believes that the company’s voice and SMS revenue will be gone within three years. If we strip away these declining revenue streams, we’re left with the future of an operator’s business, namely internet/data connectivity.Thus, finding the best options for monetizing data carriage is becoming critical for mobile and wireless operators. The growing number of Internet users and rapidly rising demand for a wide range of Internet services and content suggests that there's a growing market for online content and services that can be tapped. The still rapid growth in mobile and mobile video data traffic, as seen in the latest Cisco report amply reflects continuing demand. The report also suggests that usage patterns are still evolving, and can be influenced by pricing strategy. Understanding the motives and behaviors of users, particularly in response to pricing changes and strategies, will be vital for long-term business success, either as a access provider or content and service provider.

Sources - Improved traffic distribution indicates that operators are managing assets more effectively, telecoms.com

Cisco Visual Networking Index: Global Mobile Data Traffic Forecast Update, 2012-1027, Cisco press release.

Cisco Visual Networking Indes: Global Mobile Data Traffic Forecast Update, 2012-2017. Full report from Cisco.

No comments:

Post a Comment