Second, coverage of Roosevelt's Rough Riders embarking for Cuba during Spanish American War (1898)

Third, a Cuban ambush of a Spanish patrol (looks kind of staged- actually most of the battles filmed look like they were staged re-enactments). (1898)

This blog is affiliated with a course at the School of Journalism & Electronic Media at the University of Tennessee, Knoxville. I'll try to use it to share relevant news and information with the class, and anyone else who's interested.

“I’m very skeptical that in the long term you are going to have a hard copy daily newspaper in each market,” Mr. Huber, an analyst with Huber Research Partners, said.Sources - Print is Down, and Now Out, New York Times

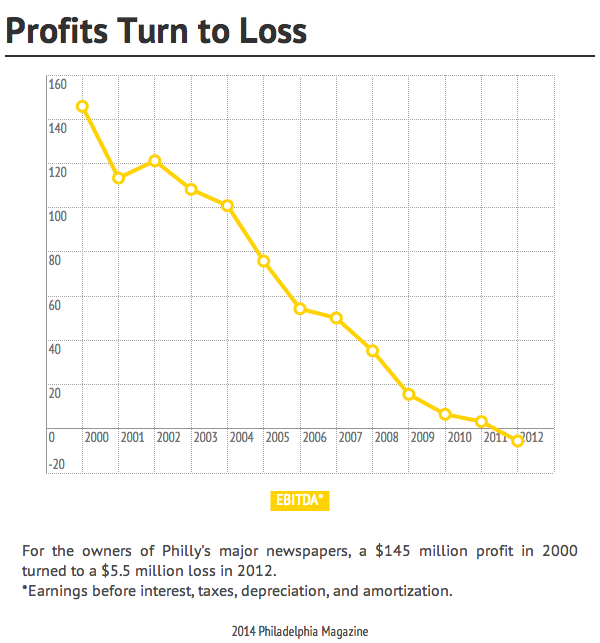

A good piece by Joel Mathis on the decline and fall of the Philadelphia Inquirer and Daily News. Working from a financial report, he tracks the progress from being a reliable cash cow to bankruptcy in a little over a decade.

A good piece by Joel Mathis on the decline and fall of the Philadelphia Inquirer and Daily News. Working from a financial report, he tracks the progress from being a reliable cash cow to bankruptcy in a little over a decade. Now that the Sprint/T-Mobile deal seems to be definitively off, GigaOm took a look back at how the top 4 U.S. mobile operators got to this point.

Now that the Sprint/T-Mobile deal seems to be definitively off, GigaOm took a look back at how the top 4 U.S. mobile operators got to this point. The July 2014 cable network news ratings are out, and the big news is MSNBC's tumble. MSNBC had a firm hold on the number two slot for months, over a faltering CNN. Last month, however, their mumbers slipped to #4 in terms of Total Day Viewing in the key 25-54 demo, and to third place in prime time viewers. On the morning front, MSNBC's Morning Show fell behind CNN's New Day, and Rachel Maddow had her second worst ratings ever.

The July 2014 cable network news ratings are out, and the big news is MSNBC's tumble. MSNBC had a firm hold on the number two slot for months, over a faltering CNN. Last month, however, their mumbers slipped to #4 in terms of Total Day Viewing in the key 25-54 demo, and to third place in prime time viewers. On the morning front, MSNBC's Morning Show fell behind CNN's New Day, and Rachel Maddow had her second worst ratings ever. Spanish-language network Univision has been trying to move from a niche network to a challenger to the Big 4. It's expanded its reach beyond urban areas with high numbers of Hispanics, adding its own stations in larger markets, picking up affiliates, and making a push to get on multichannel basic service tiers. It's worked to shift its programming focus from airing licensed series from other Latin American networks and channels, to a mix reflecting its goal of being a general-interest broadcaster.

Spanish-language network Univision has been trying to move from a niche network to a challenger to the Big 4. It's expanded its reach beyond urban areas with high numbers of Hispanics, adding its own stations in larger markets, picking up affiliates, and making a push to get on multichannel basic service tiers. It's worked to shift its programming focus from airing licensed series from other Latin American networks and channels, to a mix reflecting its goal of being a general-interest broadcaster.