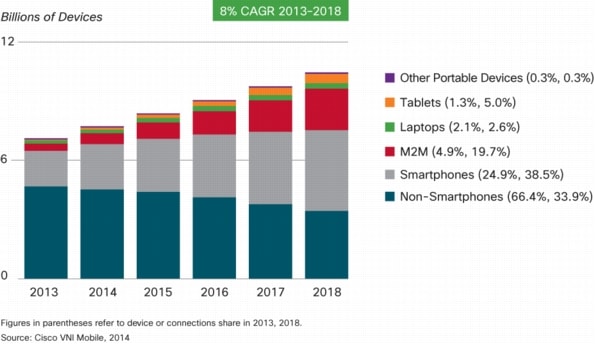

Cisco's been downgrading earlier estimates of the rate of growth of mobile data traffic (from over 70% annual rate of growth, to 66% - details in this post). Cisco's report mentioned a number of factors, from the spread of tiered pricing in mobile data plans, to declines in sales of mobile-connected laptops. But underlying these is an interceding behavioral change - users and operators are managing data traffic better, shifting high-usage traffic to WiFi and off-loading it to wired networks (about a third of mobile data traffic was shifted and offloaded to wired nets in 2012). This is helping to flatten demand and peak load demands. Between business, home, and free hotspots, WiFi usage is changing the mobile data value chain - offering users a low-cost but somewhat location-limited alternative for low-value and/or high-content apps and data streams. What's a bit amazing is how quickly and widely users have recognized the value differential and adapted to tiered data plans - 98% of iPhone users also use WiFi, as do 89% of Android smartphone users. Consumer usage patterns are beginning to shift, with mobile data usage increasingly focused on high-value, high-immediacy, and highly-localized apps and uses.

The shift is actually good news for mobile operators. The ability to offload via WiFi as a low-cost alternative is helping to improve data traffic flows and reduce peak demand levels; this will slow demand for in-network capacity upgrades. The low-cost WiFi option, in the meantime, provides a place where users can explore new apps and uses, allowing them to establish values for new apps, as well as exploit relatively low-utility markets like entertainment content, gaming, and social media. Now, mobile operators can focus on identifying, marketing, and siphoning off the high-value apps. Doing so will help operators better monetize their mobile bandwidth.

And doing so may well become critical. It's becoming more and more apparent that data is on its way to becoming the dominant revenue stream for mobile operators. The problem is particularly acute in Europe. There, major mobile operators are seeing their voice and SMS revenues falter. Growing competition within mobile, as well as low-cost alternatives (IP telephony, online conferencing, social media) in an increasingly connected world, are shrinking margins. While average revenues per user has risen 25% over the last five years in the U.S., it's actually fallen by 15% in Europe.

Swisscom's CEO, for example, has publicly predicted that their voice and SMS revenues will just about disappear within three years. The European mobile market is seriously overcrowded (100 operators, compared to 6 in the U.S.), and heavily regulated. That, and the poor economic conditions have resulted in four years of declining revenues have hit margins, and company valuations, hard. European telco stocks are trading at half the earnings multiple of U.S. mobile operators. And this has hurt their ability to raise the $800 billion the GSMA trade group has estimated is needed to upgrade to 4G by 2016.

Swisscom's CEO, for example, has publicly predicted that their voice and SMS revenues will just about disappear within three years. The European mobile market is seriously overcrowded (100 operators, compared to 6 in the U.S.), and heavily regulated. That, and the poor economic conditions have resulted in four years of declining revenues have hit margins, and company valuations, hard. European telco stocks are trading at half the earnings multiple of U.S. mobile operators. And this has hurt their ability to raise the $800 billion the GSMA trade group has estimated is needed to upgrade to 4G by 2016.For Bernstein analyst Robin Bienenstock the problem is European telcos have no confidence that investing in networks to offer superior service than rivals will pay off.Successfully negotiating the shift to data, and building out 4G's mobile broadband services, looks to be critical for mobile markets. Where data-focused and 4G systems are well on the way (U.S., several Asia-Pacific markets), operators are establishing that the demand (and monetizable values) for data-based mobile apps is there, and showing the potential for rapid growth. With their early success, and the dismal forecast for older cellular services (voice, SMS) in Europe, it's expected that European mobile operators will use the WMC to push EU regulators to get out of the way and give them a viable shot to grow the mobile broadband market. Good luck with that.

"So they don't invest, they just cut costs and tweak pricing, locking themselves in a vicious cycle of selling an increasingly commoditized service," she said.

"If you are an American consumer, especially in a big city, there has been a tangible improvement in what you're being offered on mobile speeds, whereas for Europeans, there has been a deterioration in quality."

Sources - Improved traffic distribution indicates that operators are managing assets more effectively, Telecoms.com

Divide between European and US telcos widens, TelecomEngine

Cisco Visual Networking Index: Global Mobile Data Traffic Update, 2012-2017, Cisco white paper

Understanding today's smartphone user: Demystifying data usage trends on cellular and Wi-Fi networks, Informa white paper.